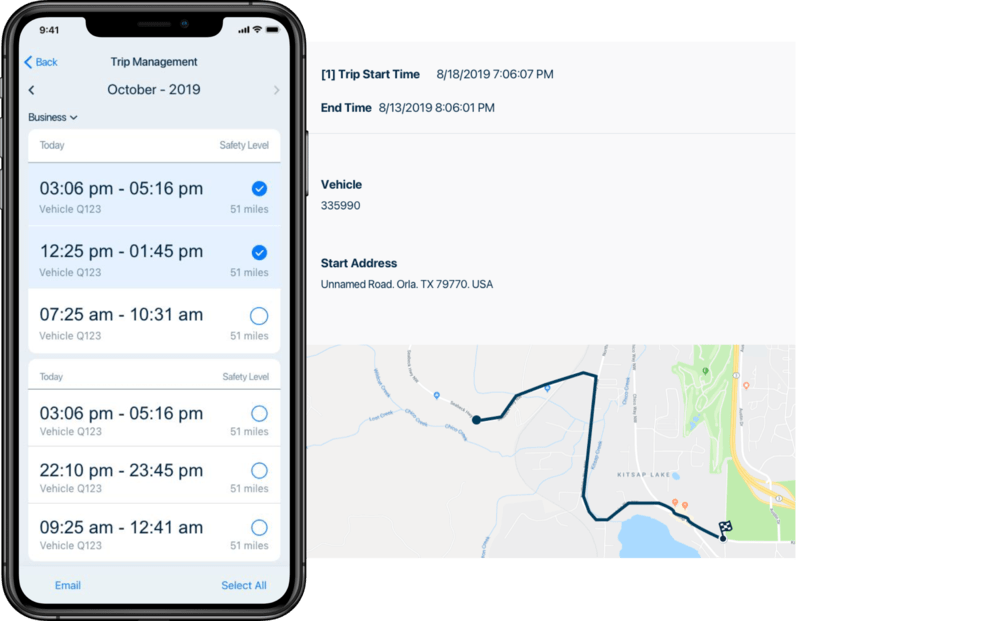

When your drivers don’t keep accurate vehicle use records, you miss out on valuable tax breaks and risk liability for poor tax compliance. GreenRoad takes the hassle out of HMRC reporting by leveraging existing GPS tracking trip data to easily classify driving segments. Whether your drivers or service technicians use fleet vehicles for personal trips or use their own cars for business purposes, our data makes it easy to fill out expense reports and tax returns.